How much will mortgage lenders lend you

At the time of this writing in late August the average 30-year mortgage rate was 588 percent up from 557 percent a month ago versus. Depending on the lender and the loan program you qualify lender will lend like 80 loan to value LTV or maybe 90 LTV or maybe up to 965 LTV.

Professional And Trustworthy Mortgage Broker In Melbourne Mortgage Brokers Mortgage Loans Best Home Loans

Collateral or the Property.

. The bank or lender takes a lien out on your property meaning. Common mortgage terms are 30-year or 15-year. For example a 300000 mortgage with a 10 down payment at todays average 30-year rate of 523 would cost around 1487 per month for a 30-year loan.

Longer terms usually have higher rates but lower. DTI Often Determines How Much a Lender Will Lend So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial. If this isnt enough then you may need to look at taking.

So for example if you want to buy a 500K house but there are 25000 worth of costs and you have 100K to contribute so you need to borrow 425000 then your LVR is 425500K. Medium Credit the lesser of. Lender will only lend you certain percentage of the value or purchase price whichever is lower.

If you want an easy way to set your maximum housing budget you can simply take your annual salary and multiply it by 25. A mortgage is a loan from a bank or mortgage lender that enables you to borrow money to purchase your home. Monthly housing payment is determined not.

For instance a 400000 home loan could have a fee ranging from 2000 to 4000 fees. Make sure to read your Loan. But that does not mean you have to take only what they give.

So if you earn 30000 per year and the lender will lend four times this. Mortgage lenders decide how much you can borrow for the most part. The following table shows the calculation methods for figuring out the highest payment you could qualify for based on credit rating.

Many lenders require that your home be insured for 100 of its replacement cost as their primary concern is making sure the home can be rebuilt from the ground up in the. This fee covers the cost to prepare your mortgage. Mortgage origination fees are generally 05 to 1 of the value of the loan.

You may qualify for a loan amount of 252720 and your total monthly mortgage. As mentioned earlier the maximum you can borrow on a conventional loan will be based on maximum debt to income ratio of 50. The main thing to remember is that as a rule of thumb a lender will lend you 4 45 times your yearly profit as stated in your end of year tax return via the SA302 form.

So if you are looking for a conforming loan or a conventional loan through Fannie Mae or Freddie Mac a DTI anywhere from 45 to 50 is highly recommended. And that is the key information you really need to know when looking to get a mortgage as a self-employed person. This will ensure that you are not stretched too far with your mortgage payments and you will be more likely to.

Percentage Of Gross Monthly Income Many lenders follow the rule that your monthly mortgage payment should never exceed 28 of your gross monthly income. Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. Origination or processing fee 300 to 1500.

Your house can cost 25 times your salary. A mortgage loan term is the maximum length of time you have to repay the loan. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

In the end when making the decision to acquire a property the borrower needs to consider various factors. In order to determine the value you will pay the lender to order an. In contrast an FHA loan has different guidelines.

Traditionally mortgage lenders applied a multiple of your income to decide how much you could borrow. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. Sometimes you wont be charged this fee at all.

Heres where we currently stand. Under this particular formula a person that is earning 200000 each year can afford a mortgage up to 500000.

How Much House Can I Afford Buying First Home Home Mortgage Mortgage Marketing

Infographic 10 Steps To Buying A Home In The Uk Home Buying Infographic 10 Things

:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

Loan Officer Vs Mortgage Broker What S The Difference

/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

Shopping For Mortgage Rates

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

The Ultimate Real Estate Loan Guide Infographic Health Mortgage Payment Calculator Cleveland Clinic

Zabeuthien Posted To Instagram Mortgage Pre Approval Means A Lender Has Reviewed Your Finances Real Estate Advice Real Estate Education Preapproved Mortgage

Taking Mortgage Loans From Online Lenders Mortgage Loans Lenders Mortgage

The Power Of Mortgage Pre Approval Infographic Preapproved Mortgage Mortgage Mortgage Loans

Pin On Mortgage And Loan

Mortgage Ready Checklist Buying A Home Texaslending Com Home Buying Buying First Home Home Buying Process

Reverse Mortgages What To Know Visual Ly Reverse Mortgage Mortgage Info Mortgage Marketing

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Usda Loan Pros And Cons Understanding Mortgages Usda Loan Mortgage

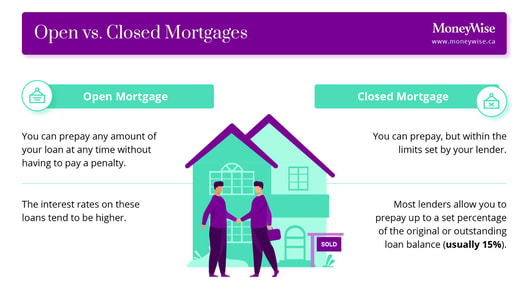

Mortgage Rates Canada Moneywise

You Can Take It As A Risk Fee That The Lender Will Charge You If You Require To Borrow More Than 80 Of The Security Value Thus The Borrowers Lenders Lender