Personal property depreciation calculator

You can reclassify your property as personal property and then use the section 179 exclusion. 946 for ADS depreciation tables.

Download Depreciation Calculator Excel Template Exceldatapro

However if the policy covers the actual cash value the money youll receive upon claims is the present value of the.

. Assets are grouped into property classes based on recovery periods of 3-year property 5-year property 7-year property 10-year property 15-year property 20-year property 25-year property 275-year residential rental property and 39-year nonresidential real property. This accumulated depreciation calculator tracks depreciation as it is used and accumulated. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab.

Vehicle finance deals. For example if you incur 20000 interest on your loan and 200 in loan fees you can claim these on your personal tax return. Property that qualifies for the Section 179 deduction includes.

The policy that covers replacement cash value will pay you the value of goods without any deduction for depreciation ie the insurer will likely reimburse you a larger sum that you can use to buy yourself the covered personal property directly. You can then calculate the depreciation at any stage of your ownership. The average car depreciation rate is 14.

Depreciation commences as soon as the property is placed in service or available. The Car Depreciation Calculator uses the following formulae. Depreciation recapture is the USA Internal Revenue Service procedure for collecting income tax on a gain realized by a taxpayer when the taxpayer disposes of an asset that had previously provided an offset to ordinary income for the taxpayer through depreciationIn other words because the IRS allows a taxpayer to deduct the depreciation of an asset from the taxpayers.

The IRS taxes part of your gain as capital gain and it taxes the depreciation-related portion at a higher rate. Under ADS personal property with no class life is depreciated using a recovery period of 12 years. A P 1 - R100 n.

544 for more information. The IRS refers to the gain that specifically relates to depreciation as unrecaptured section 1250 gain. Rental property owners use depreciation to deduct the purchase price and improvement costs from your tax returns.

What is Business Personal Property Tax. You didnt claim depreciation in prior years on a depreciable asset. View all Vehicle finance Calculators.

You recapture gain on manufactured homes and theme park structures in the 10-year class as section 1245 property. Property typically includes the furniture fixtures and equipment that are owned and used to operate a business. For 2021 you can write off up to 500000 of the cost of qualified tangible personal property.

Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. South Carolina Department of Revenue Business Personal Property Columbia SC 29214-0301 BPP Taxes Phone. Section 179 of the IRS tax code allows for the full deduction of the cost of purchasing business-related furniture with a limit of 1040000 or your business net income for 2021However the IRS has an additional cost limit of 2590000 for all section 179 property in service before it starts to reduce your possible deductionIf the purchase exceeds the upper.

MACRS Depreciation Calculator Help. Catch-up depreciation is an adjustment to correct improper depreciation. This recapture rule applies to all personal property in the 3-year 5-year and 10-year classes.

Claiming catch-up depreciation is a change in the accounting method. Use the mid-month convention for residential rental property and nonresidential real property. Loan interest Investors can claim the interest charged on a loan for an investment property and any bank fees for servicing that loan.

Above is the best source of help for the tax code. Qualified tangible personal property. Or you can use a 1031 exchange to defer.

Personal property in its most general definition can include any asset other than real estate. The distinguishing factor between personal property and real estate is that personal property is. This means that any gain you earn from selling your property will incur both capital gains taxes and other taxes.

You claimed more or less than the allowable depreciation on a depreciable asset. The depreciation of property ends when the basis or cost of the property is completely used up. See Section 1245 property in chapter 3 of Pub.

This deduction might be phased out dollar-for-dollar if you place 2 million or more of qualified tangible personal property into service in the year. Section 1245 property generally includes all personal property. The depreciation of property begins when it is placed into service for use in an income producing activity.

Car Depreciation By Make and Model Calculator Find the depreciation of your car by selecting your make and model. What Method Can I Use To Depreciate Property. For all other property use the half-year or mid-quarter convention as appropriate.

If you have a question about the calculator and what it does or does not support feel free to ask it in the comment section on this page. Use our depreciation recapture tax calculator to determine the amount youll be taxed on the sale of your rental property and find out how to avoid depreciation recapture using a 1031 exchange. D P - A.

Business Personal Property BPP Tax is a property tax on the depreciable assets of a business.

A Guide To Property Depreciation And How Much You Can Save

Appliance Depreciation Calculator

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Calculator Property Car Nerd Counter

1 Free Straight Line Depreciation Calculator Embroker

Download Depreciation Calculator Excel Template Exceldatapro

Macrs Depreciation Calculator Irs Publication 946

How To Calculate Depreciation Expense For Business

Free Macrs Depreciation Calculator For Excel

Depreciation Calculator Definition Formula

Depreciation Calculator Depreciation Of An Asset Car Property

Straight Line Depreciation Calculator And Definition Retipster

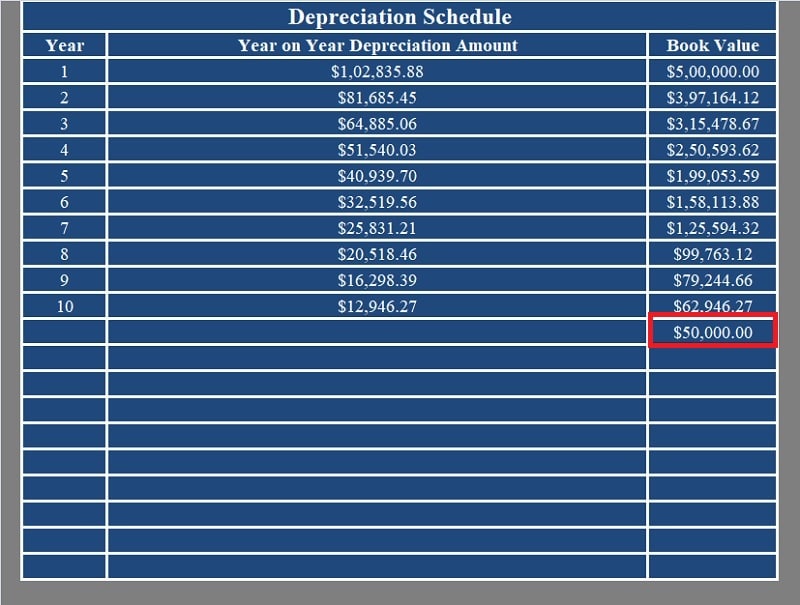

Depreciation Schedule Formula And Calculator

Macrs Depreciation Calculator Straight Line Double Declining

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Schedule Template For Straight Line And Declining Balance